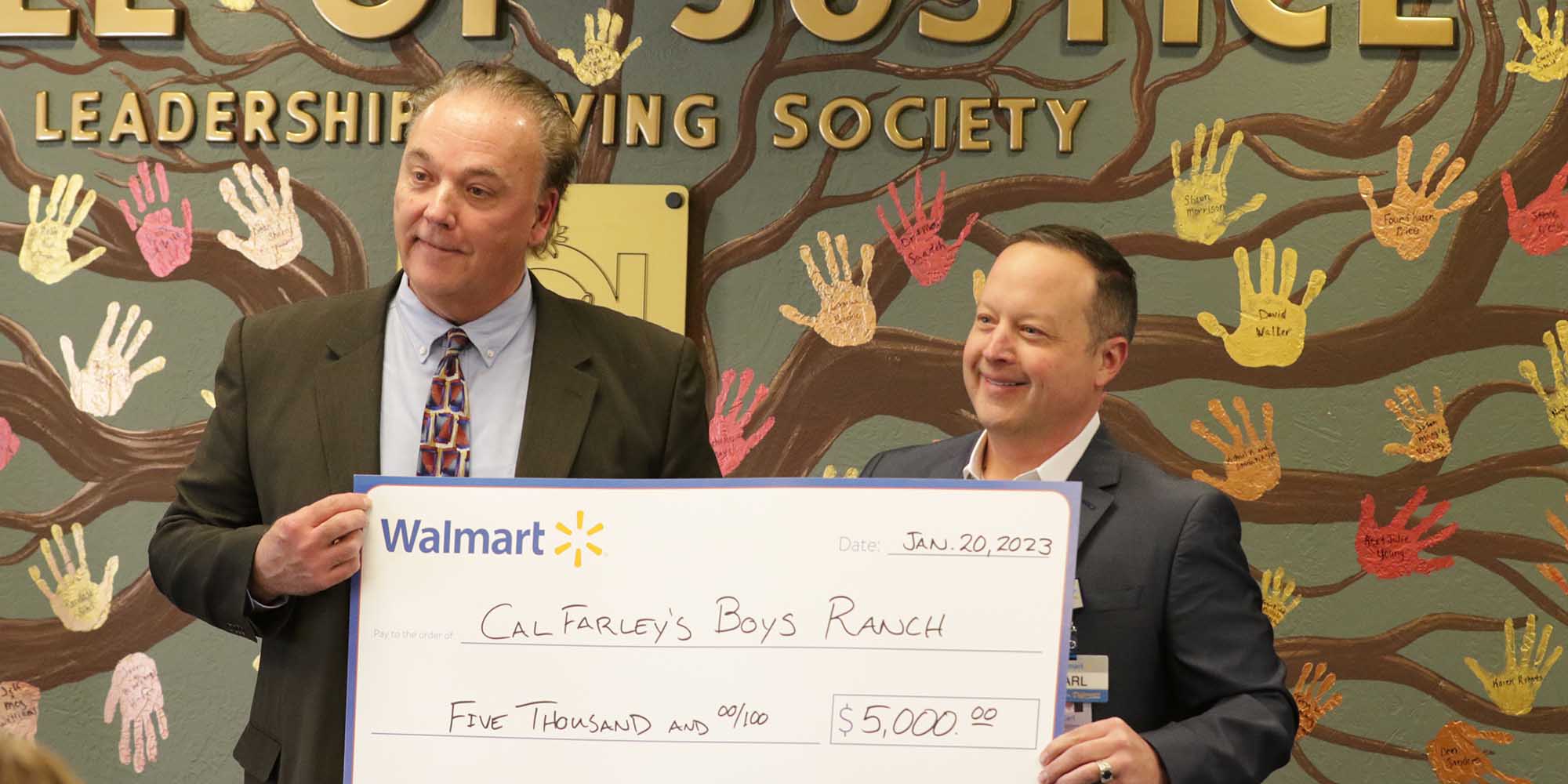

Charitable gifts included as part of your long-range estate and financial plans can offer a wonderful way to provide lasting support to Cal Farley’s and other charities you care about. You can make a “gift of a lifetime” through your charitable legacy.

Some points to remember:

- Gifts by will or trust can be funded with cash, securities, real estate or other property.

- A gift of all or a portion of the “residue” of your estate refers to property remaining after all distributions to family and others have been satisfied.

- You can choose to give a percentage of your estate, thereby allowing your gift to increase or decrease depending on the value of the assets remaining.

- A popular gift planning tool called a charitable gift annuity enables you to make a meaningful gift to Cal Farley’s while enjoying attractive fixed payments for life, tax savings and other benefits.

- Memorial gifts are often received through an estate. A memorial can serve as an enduring and loving tribute to one or more individuals while supporting Cal Farley’s.

We will be pleased to provide more information to you and your advisors concerning ways you can provide a lasting legacy while preserving financial security for you and your loved ones, click here to contact us.

This article appeared in The Heritage, Vol. 21 Number 4, 2019.